9 Questions for...Ashley Baxter

Thursday 17th July 2025Filed in: Interviews

"9 Questions For…" is an interview series in which I ask soloists, founders and leaders working in the Shopify ecosystem, as well as the wider digital and creative industries, to share their experiences of doing "their thing, their way". The questions might be the same but the insights certainly aren't! If you fit the bill and would like to share your learnings please get in touch.

In this edition of 9 Questions For…, we head north of the border to chat with Ashley Baxter, founder of the freelancer-friendly insurance company With Jack.

I've been insured through With Jack since I started my own business nearly seven years ago, and I've always been impressed by how straightforward Ashley and her team make the whole experience. It felt like the perfect time to find out more about her story.

Ashley Baxter — Founder of With Jack

Q: Are you a founder, co-founder, solo entrepreneur, consultant or something else?

I call myself a solo founder.

Q: What type of business do you run?

With Jack helps you be a confident freelancer by supporting you financially and legally if you make a mistake in your work or have a problem client.

Typically, we help freelancers with non-payment or disputes related to their work. We arrange professional indemnity, public liability, legal expenses and contents insurance for freelance designers, developers, digital marketers and most digital creatives.

Q: Why did you start your business?

It came from a few "a-ha" moments.

The first was that I was already working in insurance, but I didn't enjoy the products we sold (property insurance) or feel an affinity with the audience we were selling to (landlords). This was before the insurance industry had its big "insurtech" explosion, and I felt providers could be doing more to make the purchasing process nicer. I was drawn in from a place of wanting to start my own insurance business, but with design and technology at its core.

Ashley on stage at New Adventures

The second "why" was that I was freelancing on the side as a photographer. I felt overwhelmed with the insurance side of things. I bought an insurance package for about £300 and remember thinking, "I don't really know how this is meant to help me, but I hope I never have to find out".

I ended up having a bad experience with a client, and I credit being insured with helping me navigate it and emerge financially intact. When I started With Jack, I knew I wanted to help other freelancers protect themselves in similar situations.

Q: What's the biggest challenge you are facing in your business?

Building a business in a regulated industry is pretty horrible. I consider myself a creative, so I like to get stuck in with prototypes and test ideas quickly.

With Jack Cupcakes!

You don't really have that luxury in a regulated industry. Everything has to go through compliance and regulatory red tape. I love what I do (most of the time), but if I were to ever start another business, it definitely wouldn't be in a regulated industry. Oh, the freedom to ship new features!

Q: What's going well in your business?

We launched a credit control service called Timely, and it's helped our customers recover almost £40,000 in unpaid invoices so far. The late payment side of things is something I want to work on more.

There's a formal late payment process to follow, but most freelancers aren't aware of their rights. I'm going to try and productise this.

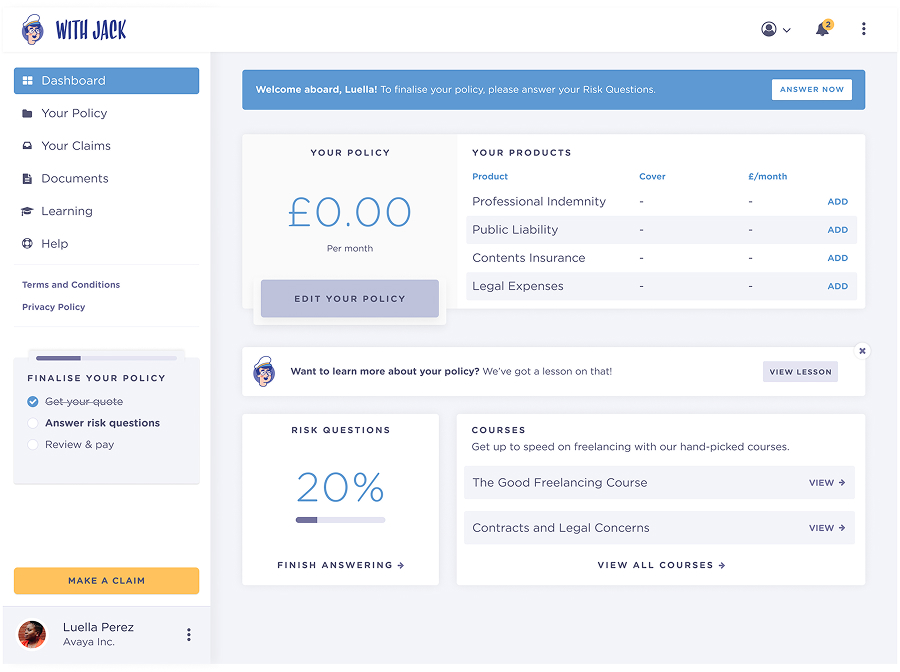

The With Jack Dashboard

Freelancers don't always see the value in getting insured, but if there's one thing they understand, it's the importance of cash flow, so they find value in tools that can help them get paid.

Q: What skill do you excel at, and which one do you want to get better at?

Due to my unique background in both insurance and freelancing, I excel at breaking down complex products in a way that freelancers can understand. Policy wordings can be confusing, but I think I'm skilled at extracting the relevant information and explaining how it actually works.

Is managing your emotions a skill? I wish I could get better at that. If my business has a poorly performing week, my mind dramatises the outcome and I convince myself things aren't working. I'm nine years into this, you'd think I'd be better at managing my emotions.

Q: What will be different about your business this time next year?

We're close to launching our self-service quote and bind system! For the past nine years, we have been manually processing every quote, mid-term adjustment, renewal and cancellation, but soon people will be able to buy and manage their insurance directly on With Jack's website.

I can't wait to see what I can achieve when I'm not constantly doing admin and can instead focus my time and energy on delivering more value to freelancers.

Q: What's the one thing you wish you'd known before starting your entrepreneurial adventure?

I wish I'd known that your product is likely to change over time, so there's no need to get too hung up on it early on. What really matters is getting the audience right.

Most people measure that by asking, "Is this a big enough audience to make money?" — and there's nothing wrong with that. But for me, it's more about asking, "Am I excited enough about this audience to dedicate the next 10+ years to helping them?"

Now that I've built a business with a few thousand customers in the freelance space, I can start testing other ideas — like the credit control service I mentioned earlier — and that really excites me.

In the beginning, I was so focused on insurance. But over time, I've realised it's actually about getting clear on your audience and evolving your offering as you learn more about what they need.

Q: Where do you live, and what do you love about your city?

I live in Glasgow. The city's nickname is "Dear Green Place" because we have so many luscious parks, which is great if you're a dog owner like me!

Other Interviews You May Like

Subscribe to Flying ✈️ Solo

Flying Solo is my email newsletter where I share my thoughts on marketing, building a solo business, and life in the Shopify Partner ecosystem — with the occasional detour into useful links, upcoming events, and honest behind-the-scenes lessons. It's 100% free and you can unsubscribe at any time. Read Issue #07 sent on 16 September 2025.